If your debit card qualifies for this option, you’ll see an option to fund the debit card immediately after signing your credit documents online. If your debit card qualifies for this option, you’ll see an option to fund the debit card immediately after signing your credit documents online. Instant Cash Advance follows OLA and CFSA best practices for lenders and federal and state payday regulations. If your debit card qualifies for this option, you’ll see an option for instant funding on the debit cardafter signing your credit documents online.

Be sure to include your debit card number when completing your online application to see if your card is eligible for instant financing. If your debit card is eligible for this option, you will be presented with an option to instantly deposit to the debit cardafter signing your credit documents online. You don’t have to wait for the money to reach your bank account and can cover an expense with a simple swipe of your card. If your debit card qualifies for this option, you’ll see an option to fund the debit card immediately after signing your credit documents online.

Once the money is on your card, you can use it for anything you want.

Can you get a loan with your debit card?

Lack of a current account is no longer a barrier to borrowing as there is a possibility that the loan will be credited to your debit card. If you don’t have a debit card, you can’t get a payday loan with it for more than two weeks. In terms of where the money comes from, a cash advance with a debit card is exactly the same as withdrawing money from an ATM.

What is instant financing with debit cards?

The only difference is having a valid debit card on file and opting for automatic debit card payment when signing the contract. From the first debit or prepaid card transaction, the data is automatically validated, securely tokenized, stored and financed. If you receive a monthly salary or government claim check as your only source of income, you have the right to claim one of the payday loans with an SSI debit card. This digital nature makes these cards easy and effective to use, and helps you keep track of financial operations.

Remember that the annual interest rate for an advance can be higher than the APR for purchases made with the same credit card.

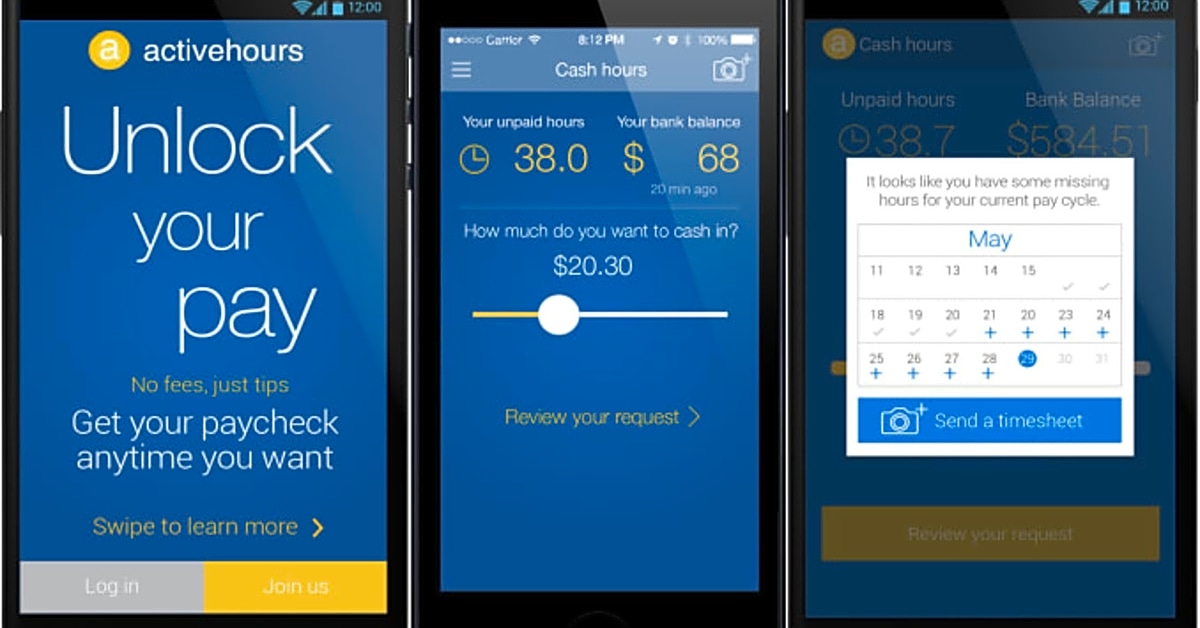

Which credit app will give you instant money?

Look no further because if you’re looking for more ways to make money online, these are literally the best free money making apps that can make you real money. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence about what action to take next. An instant loan app is an app that lends you a smaller amount of money for a short period of time (often less than 30 days). PayDaySay is different from many other apps mentioned here in that it allows loans between borrowers and lenders such as payday loan companies.

Can I have a loan transferred to my prepaid debit card?

You can get payday loanswith a prepaid debit cardas lenders like LoanSolution accept this payment option. Payday loans, installment loans, and car loans come with high interest rates and fees that can get you involved in a debt cycle. If you have a card, this is enough for the lender to transfer money directly to the prepaid debit card. To start comparing options for a lender, please go to the Personalize Your Credit Options page.

So, if you’re wondering if you can get a no-bank loan with your prepaid debit card, the answer is yes. Once the lender approves your request, you’ll receive the money in a credit account and the prepaid card will be linked to it.

.